Introduction to Digital India and UPI

The Digital India initiative, launched by the Government of India in 2015, aims to transform the nation into a digitally empowered society and knowledge economy. Its principal goals include bridging the digital divide, improving digital infrastructure, and ensuring that government services are accessible electronically to citizens. By fostering digital literacy and expanding internet accessibility, the initiative seeks to equip millions of Indians with the tools necessary to engage in a modern economic landscape.

One of the most significant developments under the Digital India banner is the introduction of the Unified Payments Interface (UPI). Launched in April 2016, UPI is a real-time payment system that enables users to link their bank accounts to an application on their smartphones. This revolutionary platform allows for seamless peer-to-peer transactions and bill payments, facilitating cashless interactions in everyday life. With UPI, individuals can easily transfer money to friends, pay for goods and services, and conduct business transactions—all with a few taps on their mobile devices.

UPI operates by consolidating several banking features into a single mobile application, making it user-friendly and efficient. It allows for immediate payments, facilitates multiple bank accounts, and eliminates the need for cash transactions, thereby promoting financial inclusion for underbanked populations. As a result, UPI has emerged as a leading force in the drive towards cashless transactions in India, especially in rural and semi-urban areas where traditional banking may not be as accessible. The integration of UPI within the broader framework of Digital India underscores the significance of technology in achieving economic equity and accessibility across diverse demographics.

The Role of UPI in Financial Inclusion

Unified Payments Interface (UPI) has been pivotal in reshaping the landscape of financial services in India, particularly in fostering financial inclusion among the unbanked and underbanked population. By offering a seamless and user-friendly platform for digital transactions, UPI has successfully bridged the gap between traditional banking services and a broader segment of society. One of the noteworthy features of UPI is its ease of use; even individuals with minimal technological literacy can engage in transactions with just a few taps on their mobile devices.

Another significant aspect that makes UPI appealing is the absence of transaction fees for users. This cost-effectiveness has encouraged many individuals to adopt digital payments, making financial services more accessible. In rural areas, where banking infrastructure is often lacking, UPI’s mobile-friendly nature has proven to be a game changer. It allows people in remote locations to conduct transactions without the need for physical banks, thereby reducing dependence on cash and enhancing liquidity.

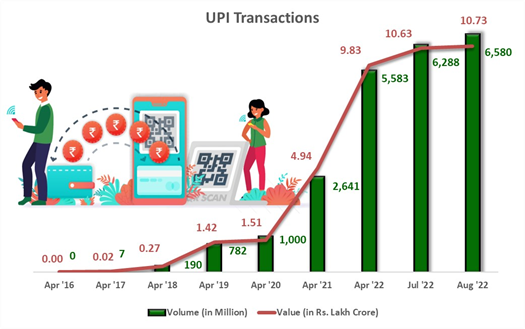

Statistics illustrate the transformative impact of UPI on banking access. For instance, prior to the implementation of UPI, only a small fraction of the rural population had access to banking services. Post-UPI, data from the National Payments Corporation of India (NPCI) suggests that the number of UPI transactions skyrocketed to over 45 billion in the fiscal year 2022-2023 alone. This surge indicates a significant leap in financial participation among previously underserved segments of the population.

Moreover, the integration of UPI with various government schemes and social welfare initiatives has facilitated a smoother distribution of benefits and subsidies directly into the hands of beneficiaries. This comprehensive approach not only empowers individuals economically but also fosters greater financial literacy and awareness among the masses, thus contributing to an inclusive financial ecosystem in India.

Challenges and Limitations of UPI

Despite the transformative potential of the Unified Payments Interface (UPI) in promoting financial inclusion across India, there remain several challenges that must be addressed. One primary concern is digital literacy, as a significant portion of the population lacks the necessary skills to navigate digital platforms effectively. This gap is particularly pronounced in rural areas where financial literacy can be limited. Without a basic understanding of how to use UPI applications, individuals may be hesitant to engage in digital transactions, thereby limiting the technology’s reach.

Another obstacle is internet connectivity. Although urban regions may have robust internet access, many rural and semi-urban demographics still struggle with inconsistent connectivity. Technical issues such as slow speeds, network outages, or lack of access to smartphones compound this challenge, preventing users from fully utilizing UPI for their financial needs. The effectiveness of UPI relies heavily on seamless internet connectivity; therefore, enhancing infrastructure in underdeveloped areas is critical for its success.

Security concerns also pose significant challenges to UPI adoption. Users may fear potential cybersecurity threats such as fraud, identity theft, or data breaches when engaging in digital transactions. Building public trust is essential, and therefore, robust security measures alongside effective educational campaigns about safe online practices are necessary to encourage wider use of UPI.

Finally, regulatory frameworks need to evolve in tandem with this technology. The lack of clear regulations can slow down the adoption process as users may be uncertain about the legal aspects of digital transactions. Establishing comprehensive guidelines that address consumer protection, transaction limits, and dispute resolution can further cultivate a sense of security among users.

In summary, overcoming these challenges—digital literacy barriers, internet connectivity issues, security apprehensions, and regulatory uncertainties—will be essential for UPI to realize its full potential in advancing financial inclusion across India.

Future of UPI and Financial Inclusion in India

The Unified Payments Interface (UPI) has emerged as a transformative force in India’s payment landscape, significantly contributing to financial inclusion. As we look towards the future, several emerging trends present a promising scenario for UPI’s role in fostering deeper financial connectivity across the nation.

One major trend is the potential for UPI integration with an array of financial services and international platforms. This could facilitate seamless transactions, not just domestically, but also cross-border payments, enhancing global access for Indian users. With increasing globalization, the need for efficient international payment systems has become imperative. UPI’s ability to facilitate easy peer-to-peer and merchant transactions could play an essential role in enabling Indian businesses to compete on a global stage.

Moreover, the rise of fintech solutions has the potential to amplify UPI’s outreach. Numerous startups are driving innovative financial products that leverage UPI’s infrastructure. By offering services such as instant loans, insurance products, and wealth management tools, these fintech firms can enhance the accessibility of financial services for underbanked populations. Integrating UPI with these offerings could streamline transactions, making it easier for users to manage their finances effectively.

In parallel, government initiatives aimed at promoting digital payments are likely to provide further impetus. Strategies directed towards enhancing digital literacy and expanding internet access will underpin broader adoption of UPI across various demographics. The government’s focus on building a robust digital ecosystem is crucial for ensuring that the benefits of UPI reach all segments of society.

Ultimately, the successful implementation of UPI could lead to significant economic and social advancements in India. Not merely a payment mechanism, UPI represents a cornerstone of a digital economy poised to elevate millions of lives, driving financial inclusion and empowering communities across the country.