The emergence of fintech startups has marked a significant transformation in the banking sector over the last decade. Driven by technological advancements, these innovative companies have successfully navigated challenges to disrupt traditional financial services. One of the most notable aspects of this rise is the proliferation of mobile banking applications, payment processing solutions, and online lending platforms, which are reshaping consumers’ expectations of financial services.

The digital economy has empowered customers, fostering a demand for more accessible and user-friendly financial tools. This shift in consumer preferences has prompted banks and financial institutions to reevaluate their offerings and embrace new technologies. Fintech startups have capitalized on this demand, presenting services that often feature lower fees, faster transactions, and enhanced user experiences. Notably, according to a report by Statista, the global fintech market is projected to reach $310 billion by 2022, indicating a robust growth trajectory within the sector.

Supportive regulatory frameworks have also facilitated the rise of fintech startups. Governments and financial authorities around the world have adopted policies aimed at fostering innovation and competition in the financial sector. These regulations often encourage collaboration between established banks and fintech companies, resulting in a more dynamic landscape. However, while navigating these regulations has posed initial challenges for startups, it has also provided a framework within which they can operate with greater legitimacy and security.

Overall, fintech startups are emerging as significant players in the banking industry, primarily due to their ability to leverage technology while addressing changing consumer demands and benefiting from favorable regulatory conditions. They are dismantling barriers that once characterized traditional banking, allowing for a more inclusive financial ecosystem.

Innovative Solutions Offered by Fintech

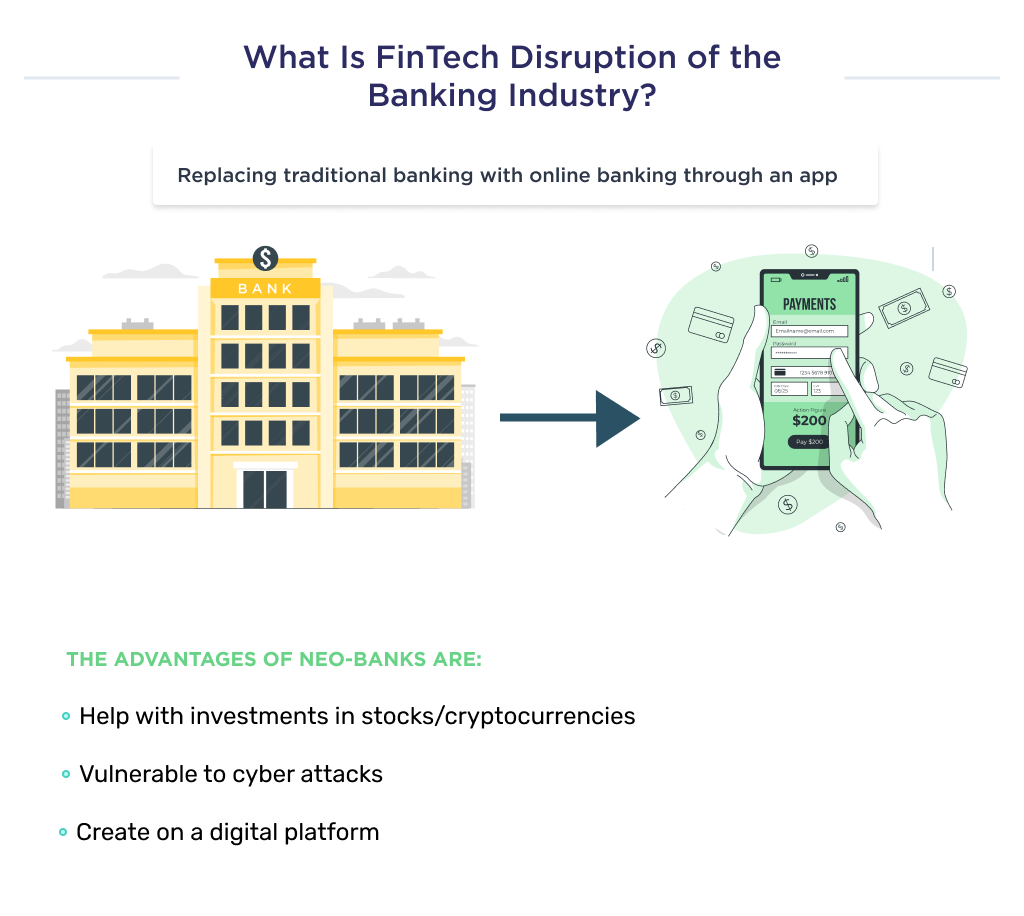

Fintech startups have emerged as transformative players in the financial services industry, leveraging advanced technologies to offer innovative solutions that fundamentally enhance customer experience. One of the most significant advancements has been the proliferation of mobile banking applications. These apps provide users with the ability to conduct banking activities conveniently from their smartphones, including tracking transactions, making payments, and transferring funds. This heightened accessibility not only caters to a broader audience but also meets the increasing demand for real-time financial information and management.

Another key innovation offered by fintech firms is peer-to-peer (P2P) lending platforms. These services allow individuals to lend and borrow money directly from each other, bypassing traditional financial institutions. By minimizing overhead costs and streamlining the lending process, P2P platforms often provide lower interest rates for borrowers and attractive returns for lenders. This disrupts conventional lending practices, enabling a more democratized approach to finance and enhancing inclusivity.

The rise of cryptocurrency services is an additional facet of fintech innovation. These services facilitate the trading, storing, and management of digital currencies, opening new avenues for investment and financial transactions. By utilizing blockchain technology, fintech startups can provide secure and transparent financial operations, which appeal to users seeking alternatives to traditional banking systems that may not meet their needs or offer the same level of security.

Lastly, automated investment tools, often referred to as robo-advisors, represent another significant breakthrough. These platforms use algorithms to create and manage investment portfolios tailored to individual risk profiles and financial goals. They democratize investment management by offering low-cost solutions that were typically reserved for affluent clients, thereby fostering a culture of financial literacy and empowerment among a wider demographic.

Challenges Faced by Traditional Banks

Traditional banks are currently navigating a landscape profoundly altered by the rise of fintech startups. One of the primary challenges they encounter is the intense competition for customer loyalty. Fintech companies often provide streamlined services, lower fees, and enhanced user experiences that appeal to a tech-savvy customer base. As these emerging players continue to gain traction, traditional institutions risk losing market share if they fail to innovate and modernize their offerings.

The need for digital transformation is more pressing than ever. Many traditional banks have legacy systems that are cumbersome and inefficient, making it challenging to pivot quickly to meet evolving customer expectations. To remain relevant, these banks must invest in modern technology, which can require significant financial outlay and a shift in organizational culture. This digital evolution is critical to addressing customer demands for real-time transactions and personalized services.

Regulatory hurdles also present notable challenges. The financial industry is highly regulated, and compliance can be complex and resource-intensive. While fintech startups often operate with more agility due to less rigid regulatory constraints, traditional banks must navigate a labyrinth of laws and regulations that govern their operations. This compliance burden can stifle innovation and delay the rollout of new digital products.

Moreover, the integration of new technologies into existing frameworks poses additional difficulties. Traditional banks find it challenging to adopt novel solutions, such as artificial intelligence and blockchain, without disrupting their current operations. As a response to these challenges, many established banks are forming strategic partnerships with fintech companies, investing in technology upgrades, or launching their own digital services. By taking proactive steps, traditional banks strive to secure their position in a rapidly changing financial landscape while catering to the evolving needs of their customers.

The Future of Digital Banking

The landscape of digital banking is continuously evolving, largely propelled by the innovations introduced by fintech startups. As we look into the future, several trends are emerging that will significantly shape the industry. One of the most notable advancements is the increased integration of artificial intelligence (AI) within banking services. From personalized customer experiences to enhanced fraud detection, AI is expected to streamline operations and improve accuracy in decision-making processes.

Furthermore, blockchain technology holds promising potential for the future of financial transactions. The decentralized nature of blockchain, combined with its ability to provide transparency and security, is likely to disrupt traditional banking systems. Financial institutions may increasingly adopt blockchain to enhance transaction speed and reduce costs associated with cross-border payments. This evolution could pave the way for more efficient, secure, and reliable banking services.

As these technologies advance, the regulatory landscape will also need to evolve to accommodate the changes brought on by fintech innovations. Regulatory frameworks are likely to adapt to ensure consumer protection while fostering innovation. Policymakers may focus on creating guidelines that encourage the growth of digital banking without stifacing innovation or risking financial stability. The establishment of such frameworks will play a crucial role in balancing regulation with the agility that fintech startups offer.

The implications for consumers and businesses are profound. Enhanced access to banking services promises to promote financial inclusion, potentially bridging gaps for underserved populations. Moreover, as banking becomes increasingly digital-first, traditional institutions will need to adapt by offering more versatile and responsive banking solutions. Together, these developments will redefine the future of banking, fundamentally transforming the ways people manage their finances and interact with financial institutions.